Banking For Businesses: Lessons and Services and Products and Therapies Provided from Your Collection of Finance Organizations

Should you run a home-based business and You Would like to transfer Funds straight from the pay check for your business bank account online, and then you must be conscious of how it functions. Such a service is different for banks and banking institutions, so you must execute just a little bit of research just before employing. You can find distinct ways in which men and women may use this type of support, also you should choose one depending on exactly what your preferences are everywhere. But regardless of what choice you use, you will find particular things that you need to consider before you apply to get a business bank account online.

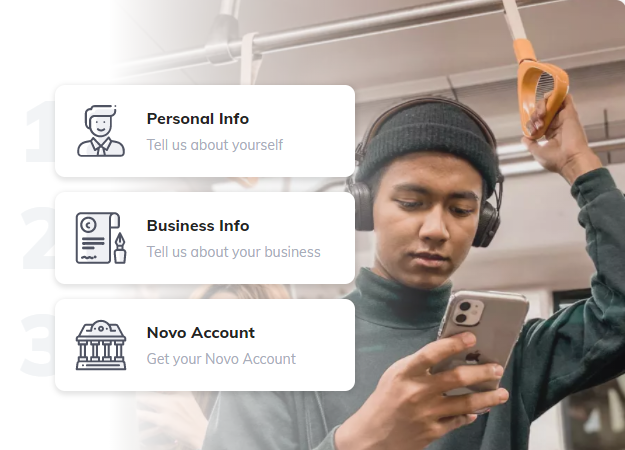

The First Thing Which you have to do will be to Choose if you Would like to have a online business banking or off line. Go to your lender’s website and download the fundamental account starting form, fill it and apply it. You will afterward obtain a message with information about ways to activate your electronic business bank accounts, and you will find an authorization code, which you’ve got to enter at the period of checkout. When you’ve submitted the form, you are going to be mechanically got a authorization code, that you simply need to enter at the good time of checkout. This really is how a on-line merchant companies account gets approved to transact business alongside you.

If you don’t want to start out an online business bank account Online, then you definitely can also go to a present-day bank and find a conventional checking account or checking account. But , you may possibly discover that it’s difficult to withdraw funds out of the savings accounts because of inadequate cash limit. Traditional checking accounts normally have a limitation on the total amount of trades you may perform each month, while savings account do not. Hence, should you desire a significant sum of money to conduct several trades monthly, then you have to get a charge card, such as MasterCard, Visa or even DiscoverCard to be able to withdraw money.

Withdrawals are processed with the banks at Precisely the Same way as Transactions over the on-line banking system. As an instance, when you opt to make a purchase at an internet retail outlet, then you enter your charge card amount, and pick the payment method you would like and enter the sum you prefer to cover the merchandise. The retailer then deducts the taxes that are applicable in the pre paid balance till you accomplish the entire sum of the sale. Businesses using prepaid debit cards may process all trades this way, with no fretting about exceeding their own limit. On-line organizations may also save expenses on administering separate money registers for purchases and cash withdrawals in addition to on regular monthly membership fees to traditional banks.

You can find other ways to start a business bank accounts, these As through banks or even through prepaid debit cards. It is important, but that you check with your accountant or tax preparer to determine whether an Internet-based business bank checking account is really a smart financial move. A few people today start out their organization checking account because a small side industry only after which expand later into other lines of commerce after they’ve established themselves at the neighborhood area market. The others, but open a business bank account online as part of the larger endeavor that will fundamentally call for paper checks. So usually, make certain to carefully think about all choices before deciding on the optimal/optimally route for you personally.

One Other key takeaway in this article is that the Simple Fact that should You really can open a business accounts, it might be done entirely on line. That you really do not have to visit the bank personally, that takes a number of the hassle out of the procedure. Expenses are automatically moved to a account, which can help save you even more funds on the long haul if you tend to work with a high-fee bank account. Check with your accountant to find out if this sort of lender is proper for you personally, but bear in your mind that most banks will probably offer some form of online banking service, therefore it is probably a good notion to look to this program too. You may wind up saving a lot of time, money, and frustrations in the event that you create your choice to go this path together with your brand new enterprise.