How to Choose the Best Online Trading Platform for Your Needs

The world of online trading has become increasingly popular, with millions of people around the globe participating in the financial markets from the comfort of their own homes. With so many options, it can be daunting to find the right trading platform that aligns perfectly with your goals. Choosing the wrong platform can result in unnecessary fees, subpar performance, or even security concerns. Here’s a quick, data-driven guide to help you make the best choice.

Understand Your Trading Goals

The first and most crucial step is identifying your trading objectives. Are you a beginner interested in learning about stocks, or are you experienced and looking to trade derivatives or cryptocurrencies? Data from 2023 showed that 60% of first-time traders prioritize simplicity in platforms, while seasoned traders want advanced charting tools and analytical features. Knowing your goals ensures that you find a platform suitable for your experience level and financial ambitions.

Evaluate Costs and Fees

Transaction costs and other fees can directly impact your trading profits. Statistics suggest that platforms with lower fees attract 45% more users than those with higher charges. Look for platforms with transparent pricing and no hidden costs. Typical fees include trading commissions, withdrawal fees, and account maintenance charges. Always compare these across platforms to minimize expenses.

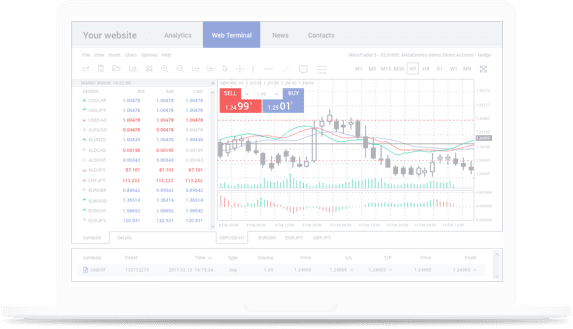

Check Accessibility and User Experience

A platform that’s easy to use is non-negotiable, especially for new traders. Reports show that 72% of users choose platforms with intuitive interfaces and mobile app compatibility. Look for platforms that provide a seamless experience on both desktop and mobile, allowing you to trade anytime, anywhere.

Prioritize Security Features

Security is a growing concern in online trading. Between 2022 and 2023, hacking incidents on financial accounts rose by 38%, underlining the importance of robust security measures. Before choosing a platform, verify its encryption methods, data protection policies, and whether it complies with financial regulations. Two-factor authentication (2FA) and strong identity verification processes are must-haves.

Research Supported Markets and Tools

Your choice of platform should align with the markets and tools you need. For example, if you’re interested in forex or options trading, ensure the platform supports these asset classes. Additionally, advanced traders may require features like technical analysis tools, real-time market data, and algorithmic trading capabilities. Trends show that platforms offering diverse tools retain 65% more users than basic platforms.

The Bottom Line

Selecting the best online trading platform boils down to understanding your needs, balancing costs, prioritizing security, and ensuring usability. Keep these factors in mind as you research options, and you’ll be one step closer to a successful trading experience. Start by outlining your goals, calculating your budget, and exploring platforms that cater to your trading style.